Today’s Israel Hayom Newspaper: Deficit Widening goes to Government for Vote.

Netanyahu, the fiscal conservative, has decided that it’s a good idea to spend even more money that Israel doesn’t have. Why? Because people want stuff without paying for it. See this clip below from the newspaper.

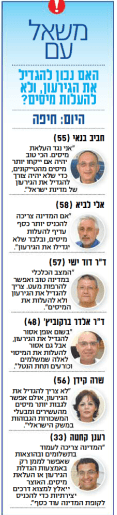

This is a poll of Israeli citizens. From top to bottom:

This is a poll of Israeli citizens. From top to bottom:

Haviv Banai (55): I am against raising taxes. It’s best if they take more money from the tycoons so we wouldn’t have to go into debt.

Eli Lavi (58): If the State needs more money, it’s better to raise taxes rather than widen the deficit.

Doctor David Yishai (57): The economic situation is good and we can relax a bit. We need widen the deficit and not raise taxes.

Doctor Eldad Berkowitz (48): We must not under any circumstances widen the deficit. Be we must not raise taxes either on those who are buckling under the pressure.

Sarah Keidan (56): We don’t need to widen the deficit, but we can raise taxes on the rich and high income earners.

Ra’anan Kahta (33): The State needs to honor its payments and we can only do that by widening the deficit or raising taxes. The treasury will need to find creative ways of getting more money into its coffers.

What’s astounding here is that nobody suggests that perhaps the government should just spend less money. It’s an option that doesn’t even exist according to everyone polled. You either raise taxes or go into debt. If the State says it needs money, then whatever – it needs money and we cannot dispute that.

What about halving the salaries of every Knesset Member? They earn what, 44,000 a month or something? They can’t survive on 22,000? how about every government employee has to pay for his own car and gasoline, just like I do, instead of the government paying for it. How about they pay for their own flights to cockamaymee events where they blow air at people? How about we eliminate the entire Shlav Bet army program from new immigrants where we waste time doing nothing for six months at 50,000 shekels a worthless soldier?

How about limiting the number of ministers in the government? How much do they make a month for doing nothing? Nobody here thinks of these things, because they are all government slaves.

Netanyahu is doing this now because he wants the people yelling in the streets for things from the government to shut up, so instead of cutting his salary, he’s endangering everybody’s income. What happens when you go too deep into debt? Ask Greece. They seem to be doing fine.